2021 FICA Tax Rates

Por um escritor misterioso

Descrição

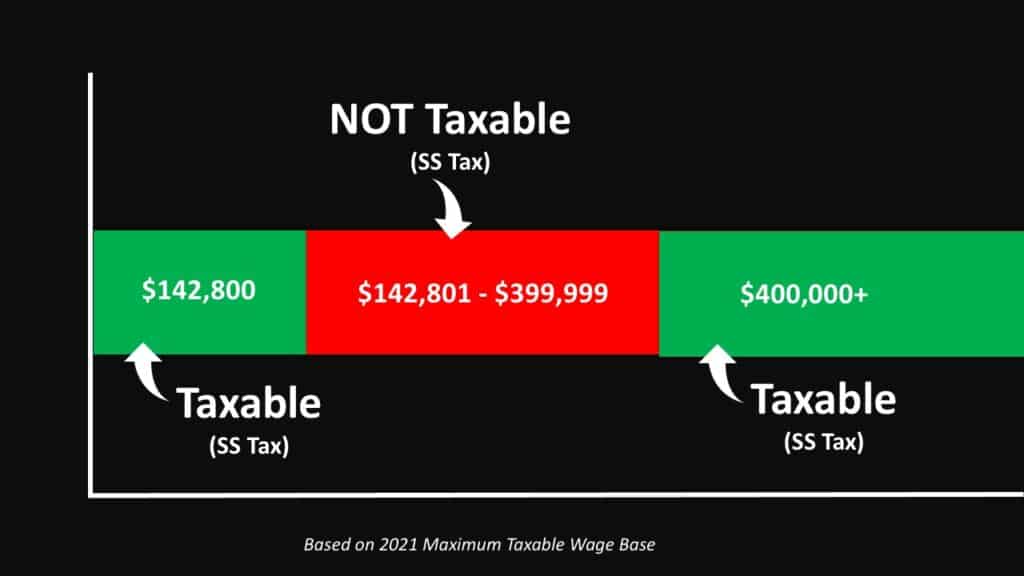

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Maximum Taxable Income Amount For Social Security Tax (FICA)

Blog: Marginal Tax Rate - Montgomery Community Media

The Myth of Fixing Social Security Through Raising Taxes – Social Security Intelligence

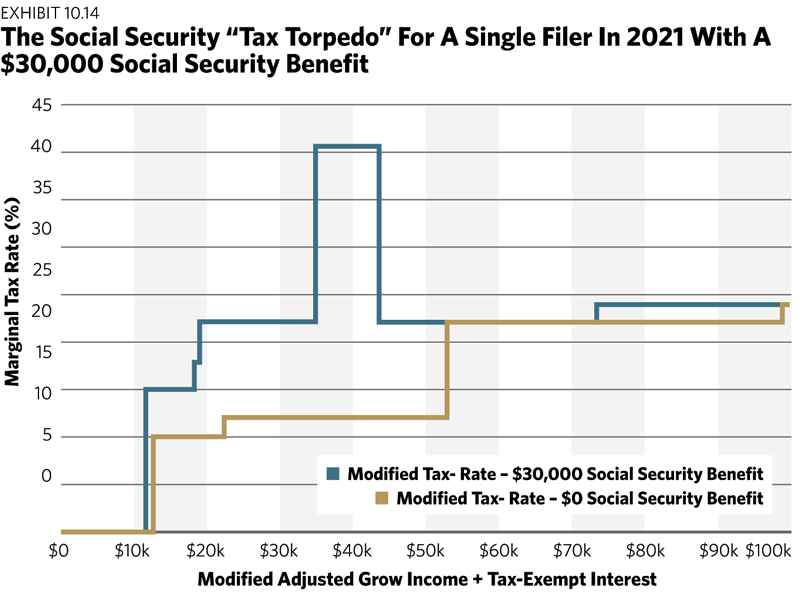

Avoiding The Social Security Tax Torpedo

Payroll Tax Rates (2023 Guide) – Forbes Advisor

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

Social Security Administration Announces 2022 Payroll Tax Increase

How Do Marginal Income Tax Rates Work — and What if We Increased Them?

What is FICA Tax? - The TurboTax Blog

de

por adulto (o preço varia de acordo com o tamanho do grupo)