What are FICA Tax Payable? – SuperfastCPA CPA Review

Por um escritor misterioso

Descrição

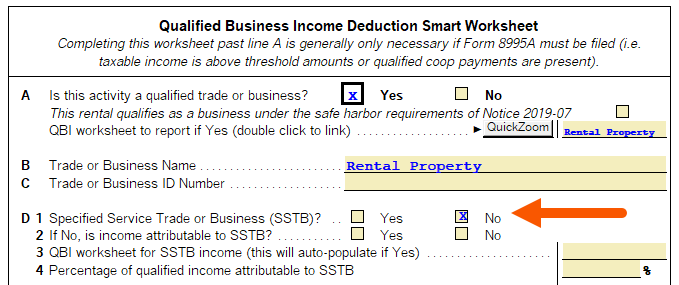

How to enter and calculate the qualified business income deduction, section 199A, in ProSeries

Accounting Terms: E – SuperfastCPA CPA Review

SuperFast CPA? : r/CPA

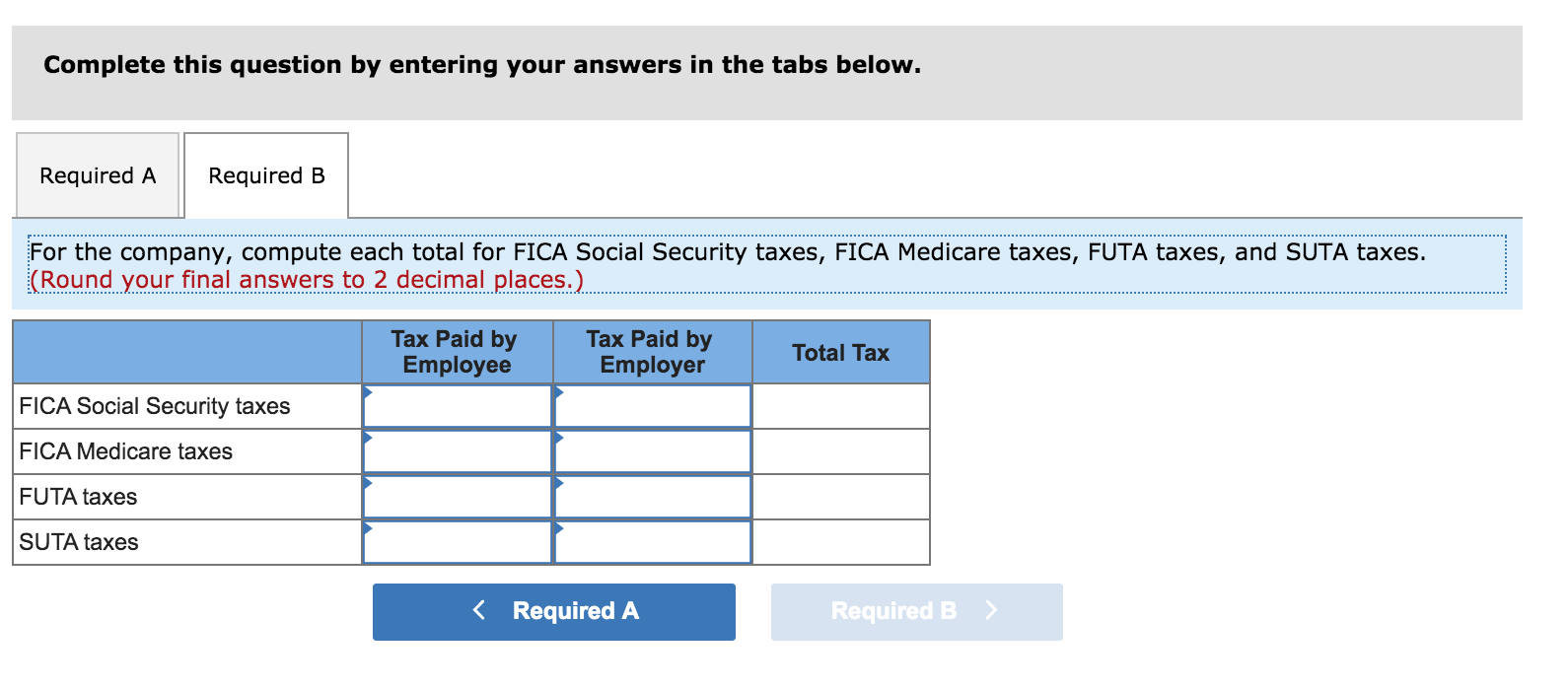

Solved Exercise 9-11 (Algo) Computing payroll taxes LO P2

Cares Act 2020 CPA Exam:Early Retirement Distribution Employee Retention Credit Non-Taxable Payment

Solved] . 2022 CLASS (2021 tax year) Form 4137 Social Security and

Taxable Social Security Calculator

FICA Taxes (Self-Employment Taxes)

Fight Inflation: Buy These 10 Items Now Before Prices Go Up

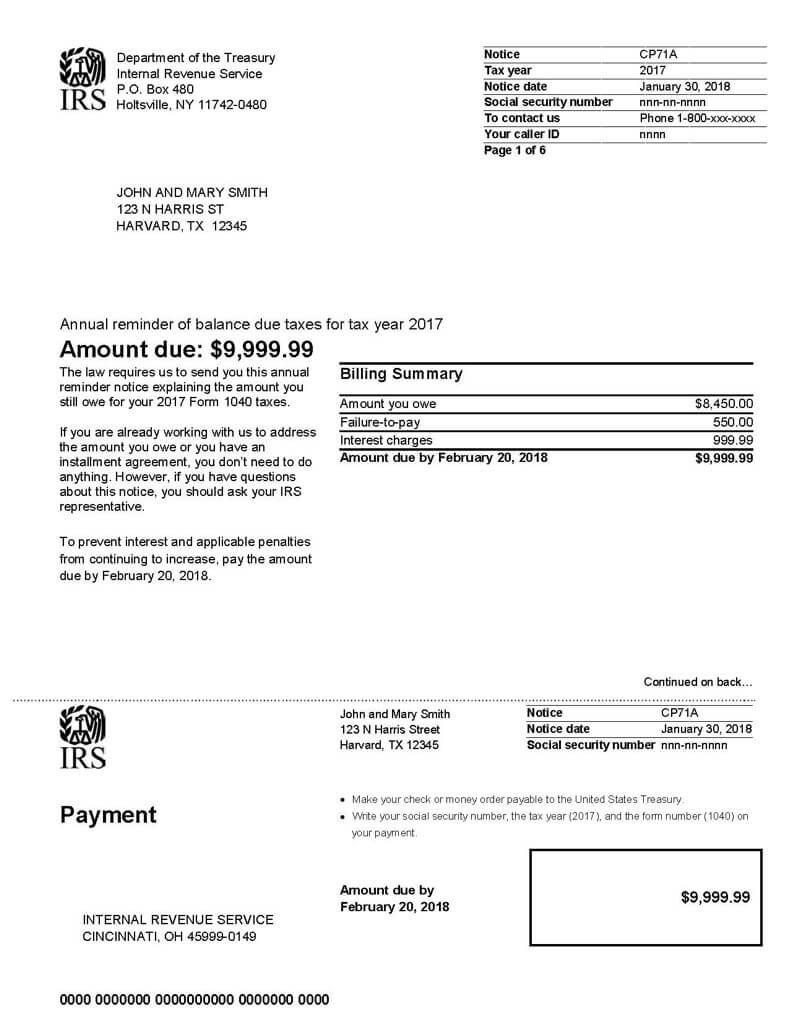

What is a CP71A IRS Notice? - Jackson Hewitt

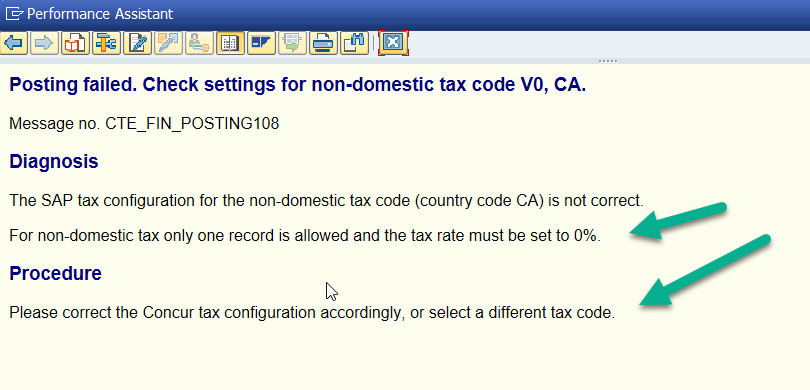

Canada Non-Domestic Tax Code Message - SAP Concur Community

IRS Form 8846 walkthrough (Credit for Employer FICA Taxes Paid on Certain Employee Tips)

What are FICA Tax Payable? – SuperfastCPA CPA Review

LO 11.5 Record Transactions Incurred in Preparing Payroll – v2 Principles of Accounting — Financial Accounting

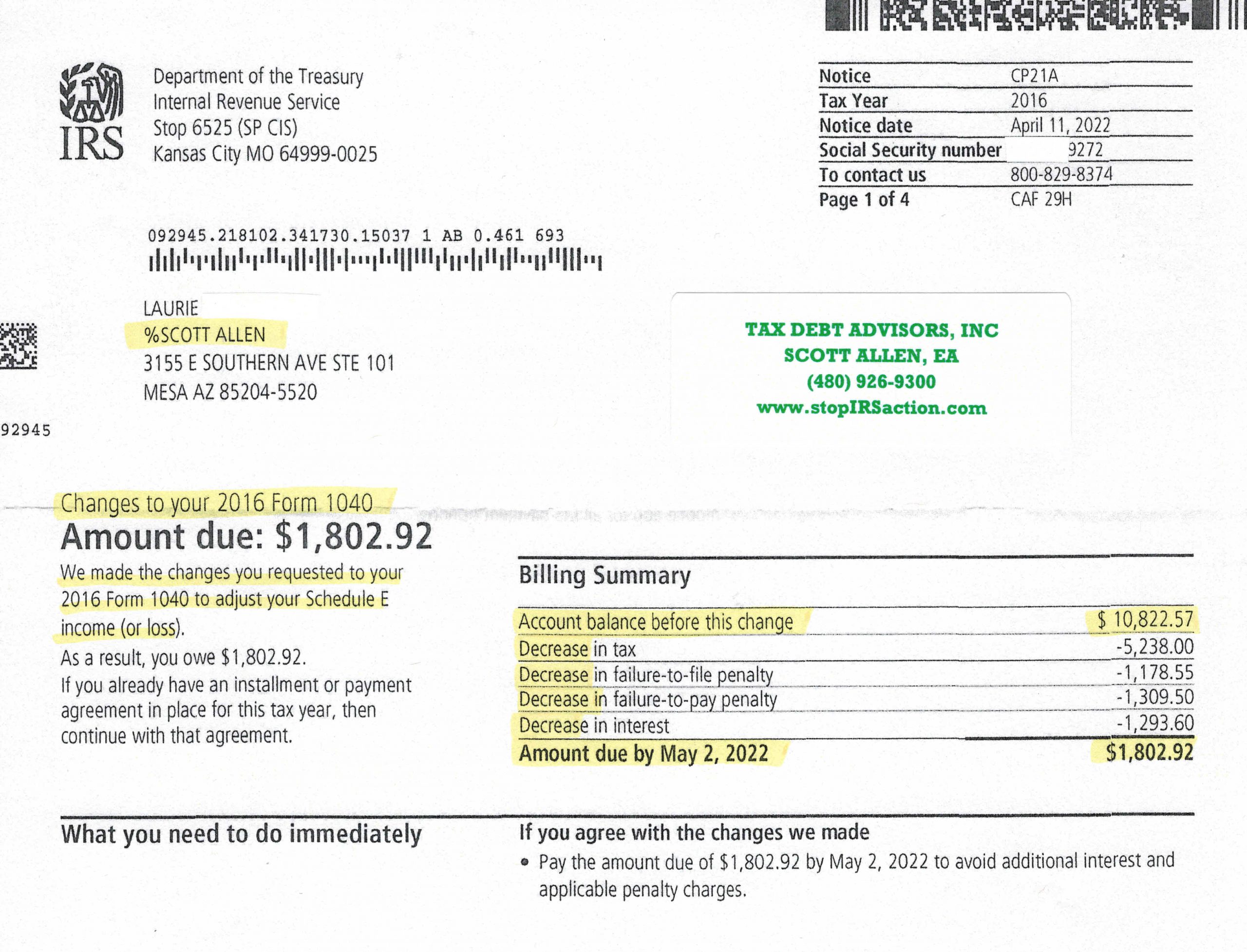

Tax Debt Advisors—What do I do when the IRS says I owe more money? – Tax Debt Advisors

de

por adulto (o preço varia de acordo com o tamanho do grupo)