Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Por um escritor misterioso

Descrição

The Federal Insurance Contributions Act (FICA) is a U.S. payroll tax deducted from workers

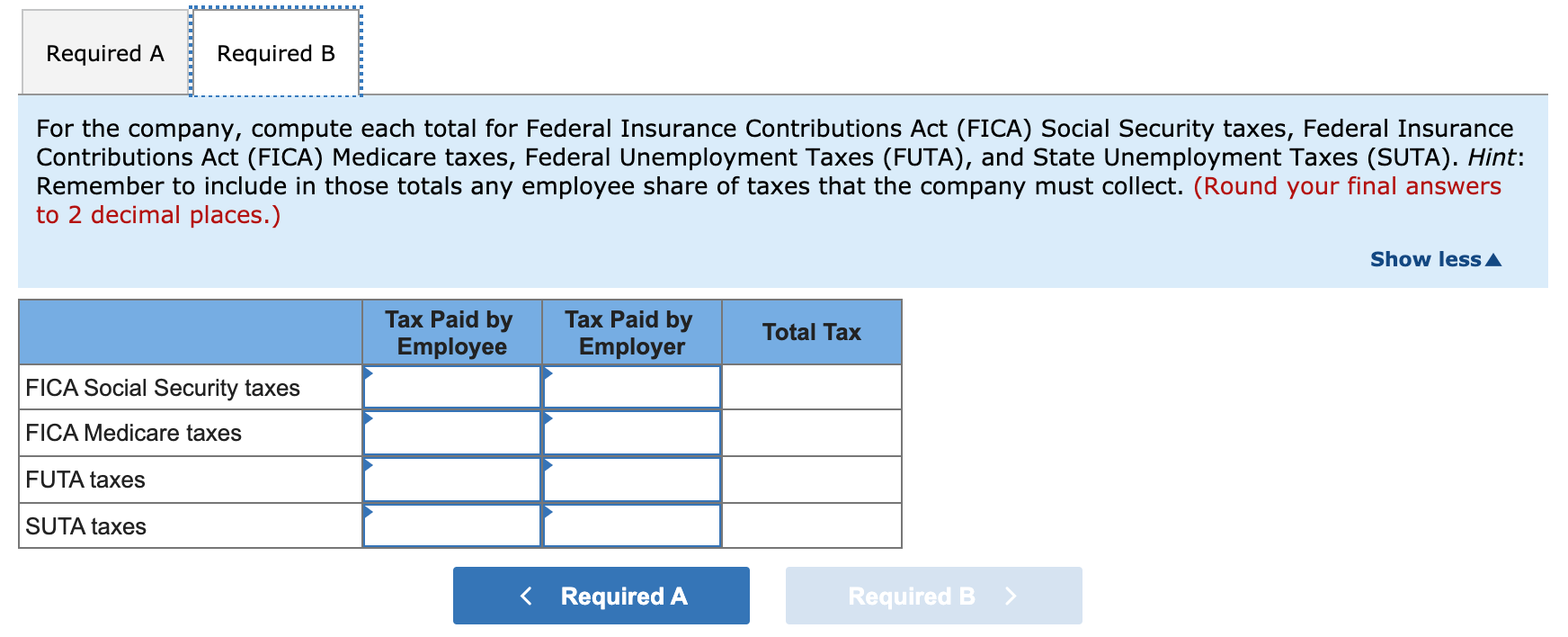

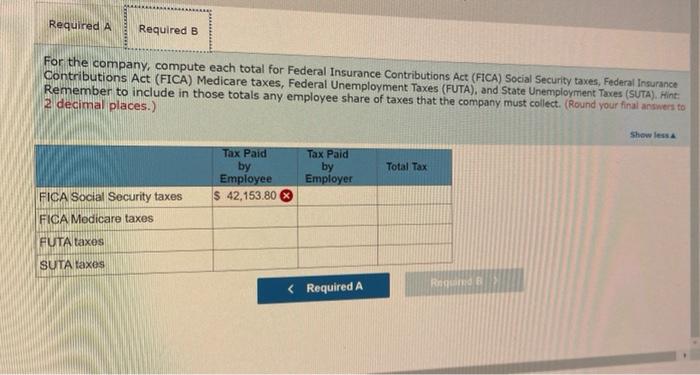

Solved Mest Company has nine employees. FICA Social Security

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

Federal Insurance Contributions Act (FICA)

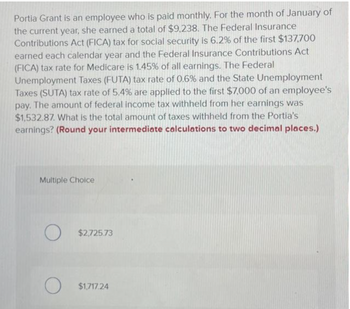

Answered: Portia Grant is an employee who is paid…

Solved] 1- An employee earned $43,600 during the year working for

The ABCs of FICA: Federal Insurance Contributions Act Explained

Federal Insurance Contributions Act - Wikipedia

Solved Mest Company has nine employees. FICA Social Security

FICA Refund: Find out if you're eligible to claim this tax refund

Federal Insurance Contributions Act ⋆ Accounting Services

:max_bytes(150000):strip_icc()/GettyImages-675764133-5b2eaa61ba6177003615be6d.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

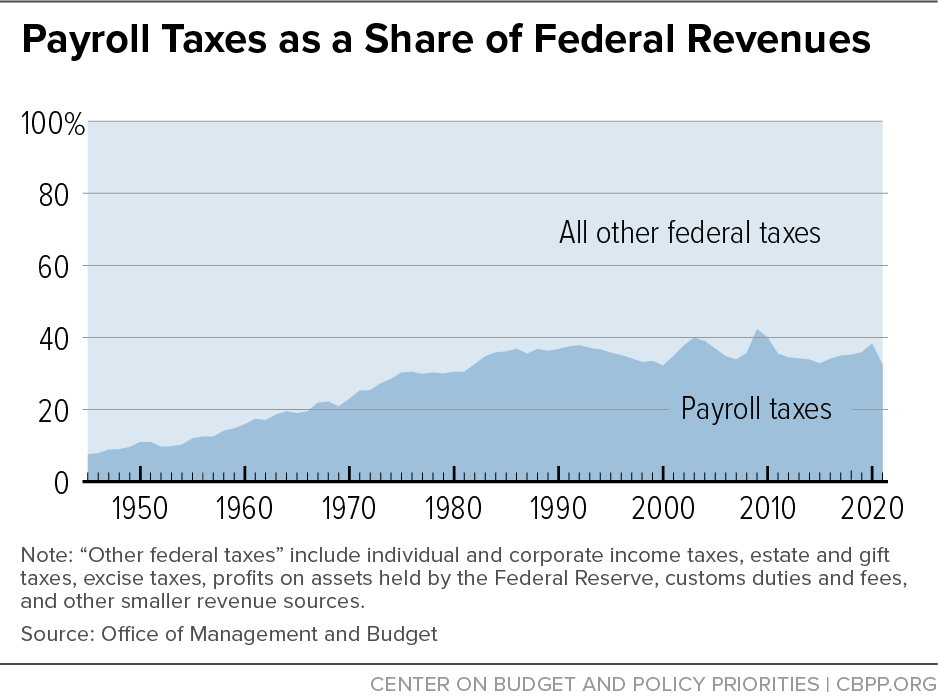

Policy Basics: Federal Payroll Taxes

FICA Tax & Who Pays It

:max_bytes(150000):strip_icc()/LizManning-INV-BW-3a1ec9a776ef4fc09313c125ed6598f3.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

:max_bytes(150000):strip_icc()/payrolltax.asp_final-f09aa1c3011c44ba925ae501bd4785ad.jpg)

The Basics on Payroll Tax

de

por adulto (o preço varia de acordo com o tamanho do grupo)