How previous home sales might affect your capital gains taxes - Los Angeles Times

Por um escritor misterioso

Descrição

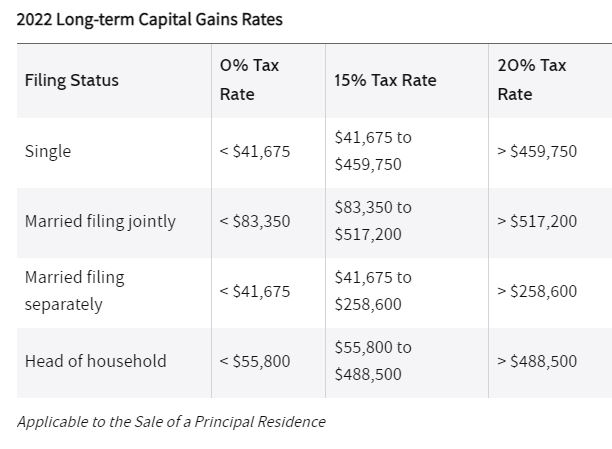

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Selling Your Residence and the Capital Gains Exclusion - Russo Law Group

Column: A tax on high-end real estate sales is gaining steam - Los Angeles Times

California Tax Consequence of Selling A House

How bank bonuses and interest payouts affect your tax bill - Los Angeles Times

Los Angeles Housing Market: Prices, Trends, Forecast 2023

Minimizing the Capital-Gains Tax on Home Sale

Avoiding capital gains tax on real estate: how the home sale exclusion works

Mansion tax' prevails in court with judge dismissing lawsuit - Los Angeles Times

Freeze in L.A. luxury market puts 'mansion tax' funds in limbo - Los Angeles Times

Understanding California's Property Taxes

Hiltzik: How the Supreme Court could block a wealth tax - Los Angeles Times

Save On Capital Gains Tax By Moving Back Into A Rental

de

por adulto (o preço varia de acordo com o tamanho do grupo)