Tax Evasion: Meaning, Definition, and Penalties

Por um escritor misterioso

Descrição

Tax evasion is an illegal practice where a person or entity intentionally does not pay due taxes.

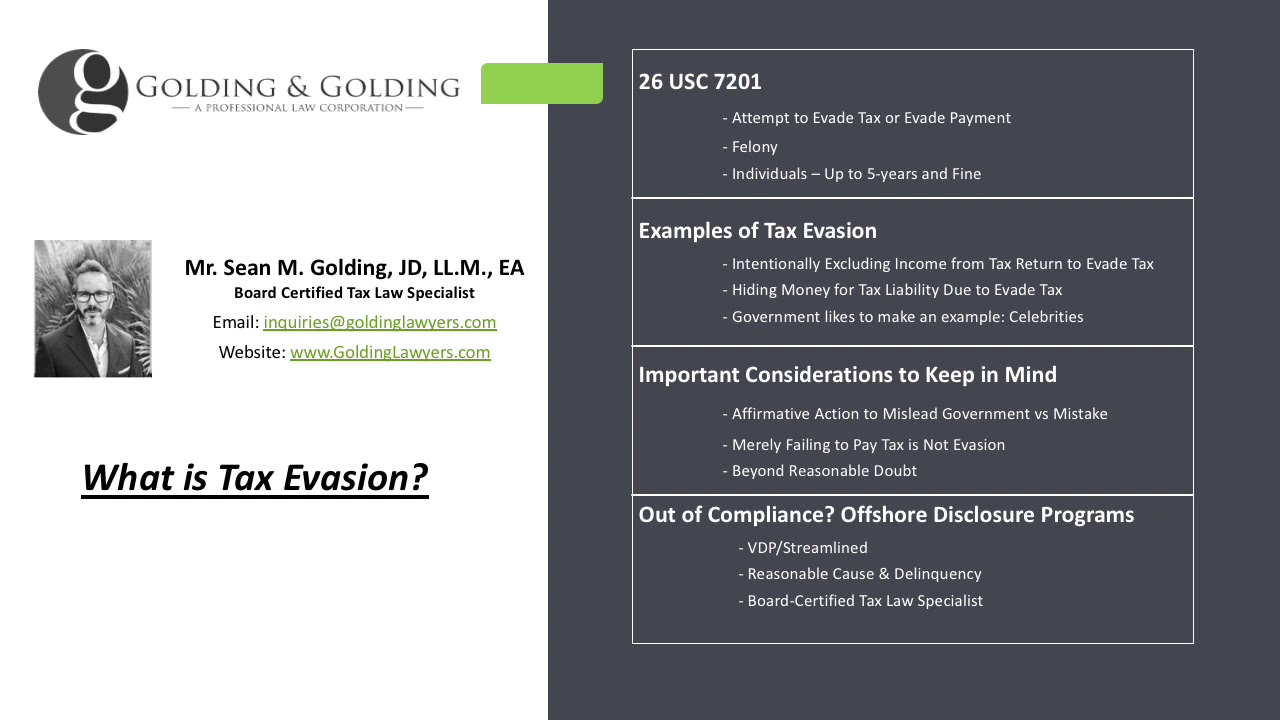

What is the Federal Crime of Tax Evasion (26 USC § 7201)

What If a Small Business Does Not File Taxes?

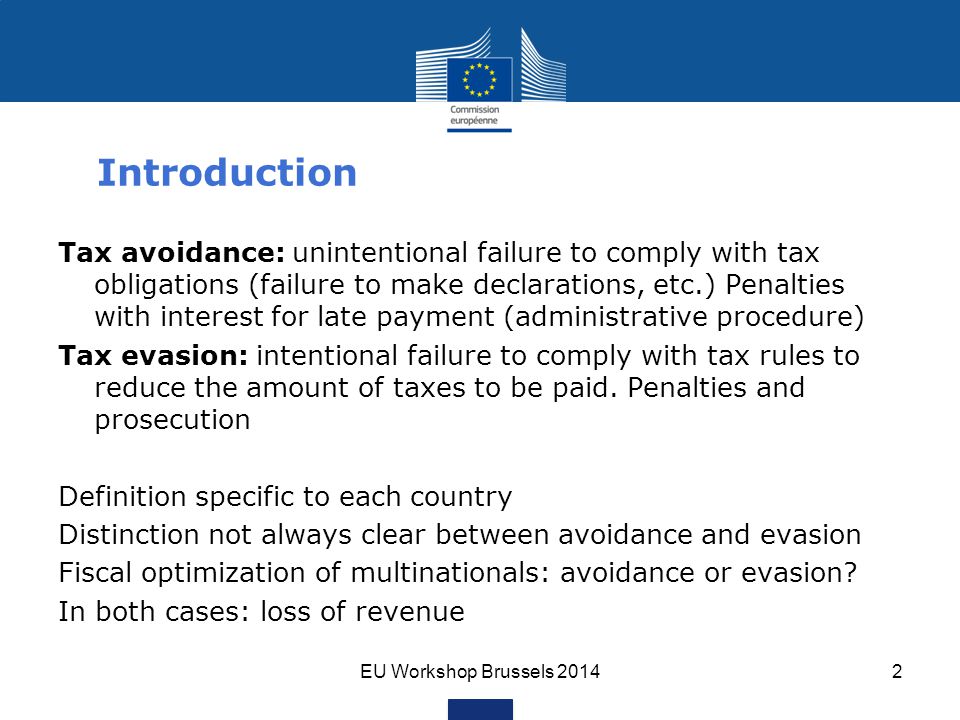

Optimisation, Avoidance, Tax Evasion - ppt video online download

Penalties and prosecution ppt

Penalties for Claiming False Deductions

Tax Evasion, What You Need To Know - The Tax Lawyer

8 AML Penalties, Fines, and Sanctions + Examples You Should Avoid - Blog

Difference Between Tax Planning

Tax Planning, Tax Evasion, Tax Avoidance and Tax Management - AVS & ASSOCIATES

Penalties, prosecution and offences under income tax act

Tax Evasion Penalties Every Taxpayer Must Know

What is the Difference Between Criminal Tax Penalties and Civil Tax Penalties?

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/FundamentalAnalysis_Final_4195918-eea2436ba2374e23930b0a482adbea2f.jpg)

:max_bytes(150000):strip_icc()/export.asp-final-b6a4a3af93a5427e85efce9c6aba9cab.jpg)