Online Games : Valuation & Classification of Service : GST Law of India

Por um escritor misterioso

Descrição

/cloudfront-us-east-2.images.arcpublishing.com/reuters/AHPZVDXDYJM6LKBVIAIWXMZECI.jpg)

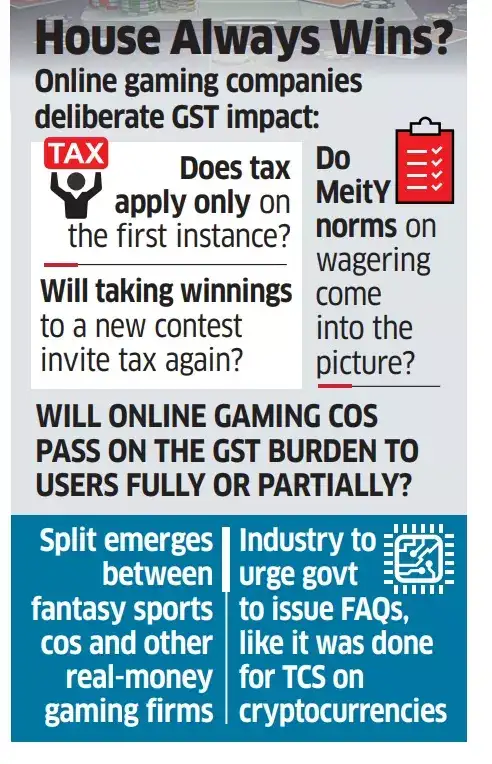

India's gaming, casino firms slide on tax blow

Online gaming's tax troubles, and other top startup & tech stories this week

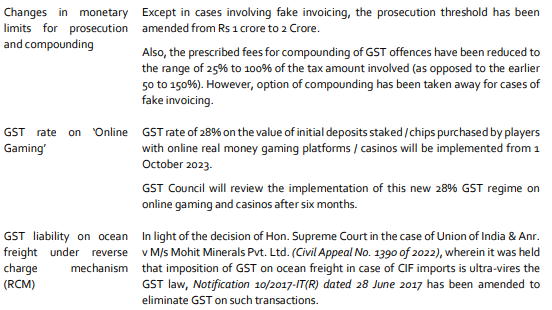

ERGO Analysing Development Impacting Business: Key Changes in GST Law Effective from 1 October 2023 - Lexology

:max_bytes(150000):strip_icc()/GoodsandServicesTax-36b9fbf71b1048a8ad617e0318af9c6b.jpg)

Goods and Services Tax (GST): Definition, Types, and How It's Calculated

Online gaming companies to collect 28% on full bet value, offshore platforms to be GST registered from October 1 - The Hindu

At your service: broadening a digital platform's scope for VAT/GST liability

GST Rates 2020 - Complete List of Goods and Services Tax Slabs

28% GST on online games: Industry expresses distress, says will wipe them out - Times of India

Taxation of Distribution of Lottery Tickets under GST

Energies, Free Full-Text

Gaming Apps in India: The Underbelly of Tax Evasion and Its Impact on the Economy

:max_bytes(150000):strip_icc()/directtax.asp-final-9c36cb6ce03647aeaee8206d164d9a44.png)

Direct Tax Definition, History, and Examples

Is tax regime for online gaming fair? - The Hindu BusinessLine

de

por adulto (o preço varia de acordo com o tamanho do grupo)