How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Descrição

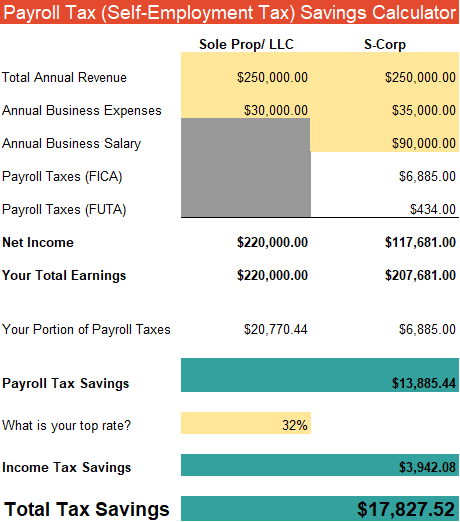

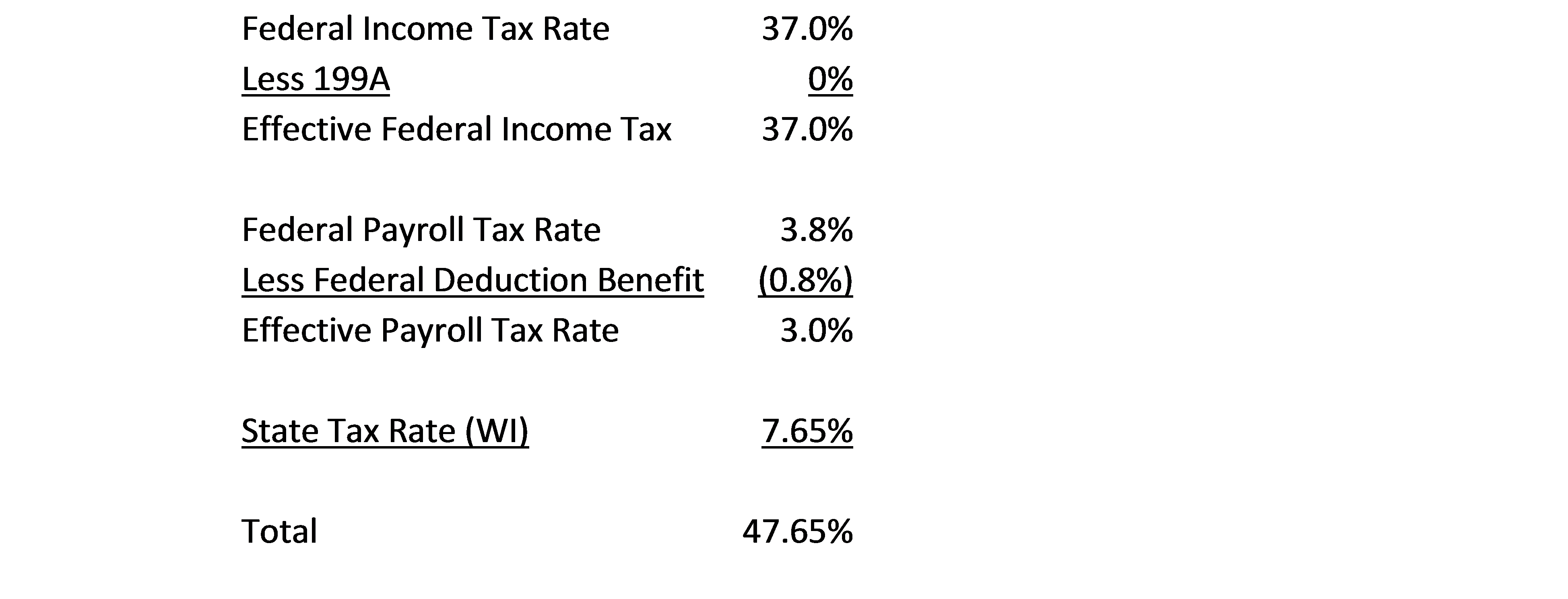

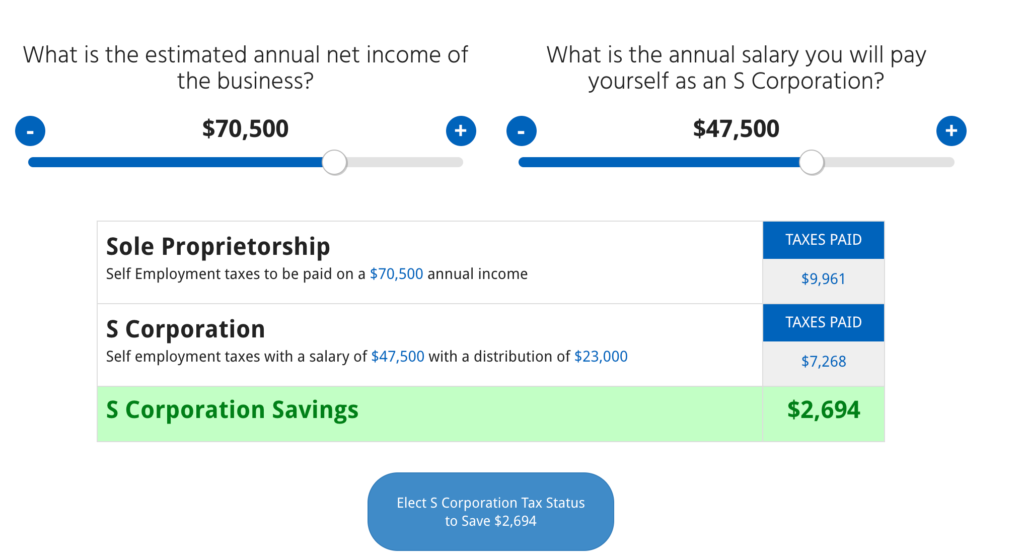

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

Considerations before making an S Corporation election for taxation - ENGAGE CPAS

CORPORATION: Calculating My Solo 401k contributions for a Corporation - My Solo 401k Financial

Are LLC Members Subject to Self-Employment Tax? - Thompson Greenspon

How to calculate self employment taxes

Home

How S Corporations Offer Federal Employment Tax Savings

Tax Foundation Needs to Fix Their Map - The S Corporation Association

How an S Corp Filing Benefits Small Businesses - Mycorporation

Current developments in S corporations

S Corp - A Comprehensive Guide to Filing Taxes

How to Minimize and Avoid Your Self-Employment Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)