Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

Por um escritor misterioso

Descrição

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax ove

Requesting FICA Tax Refunds For W2 Employees With Multiple

What is a W2 Form Wage and Tax Statement?

Where is my W-2 ? - County of Fresno

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

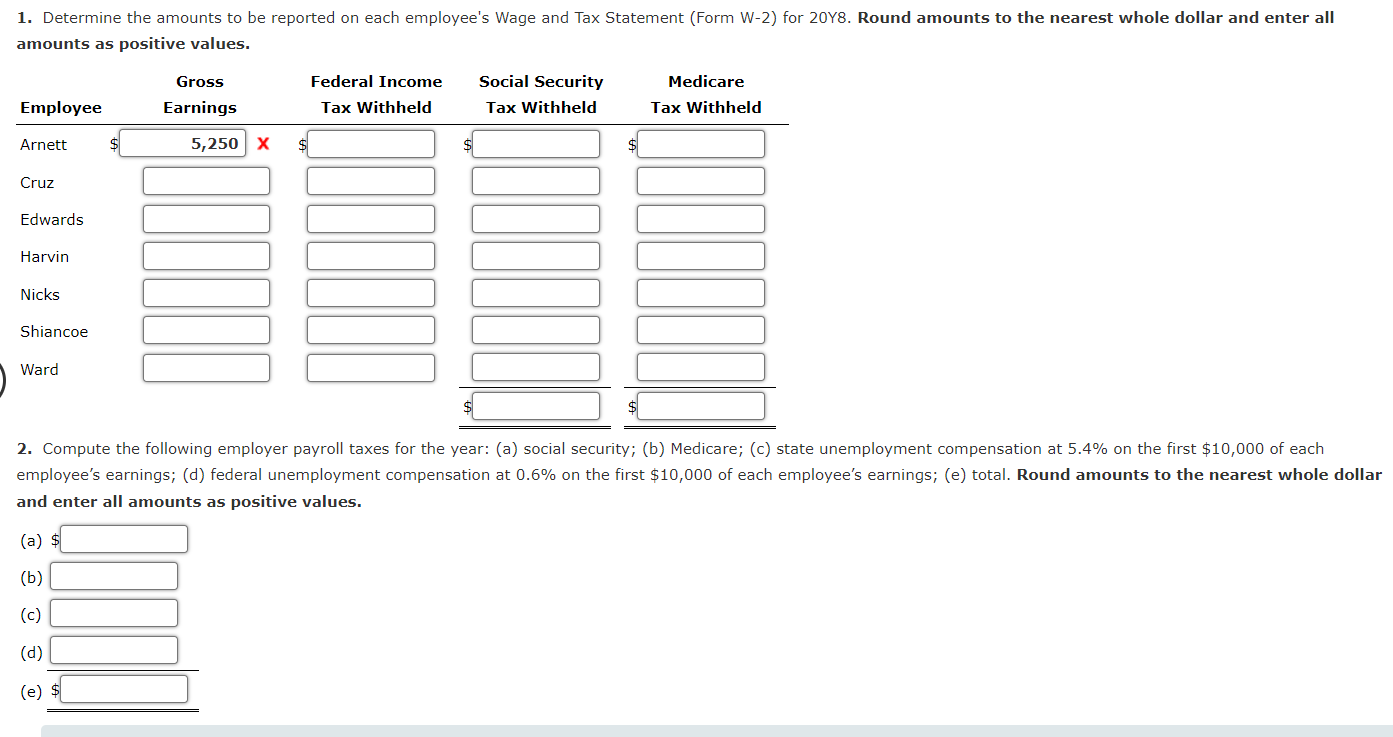

Solved Wage and Tax Statement Data on Employer FICA Tax

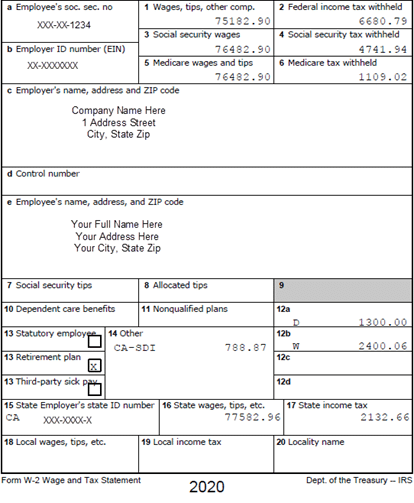

Understanding Your W2 - Innovative Business Solutions

How to Get FICA Tax Refund - F1 Visa, CPT and OPT Students

How To Read Your Military W-2

W-2s May Need to Be Corrected Due to the FFCRA

What is a W2 Form Wage and Tax Statement?

Understanding Your Tax Forms: The W-2

How to report QSEHRA benefits on IRS Form W-2 (with exceptions

FICA Tax Exemption for Nonresident Aliens Explained

IRS Form 941 Filing Requirements for Businesses in the Beauty

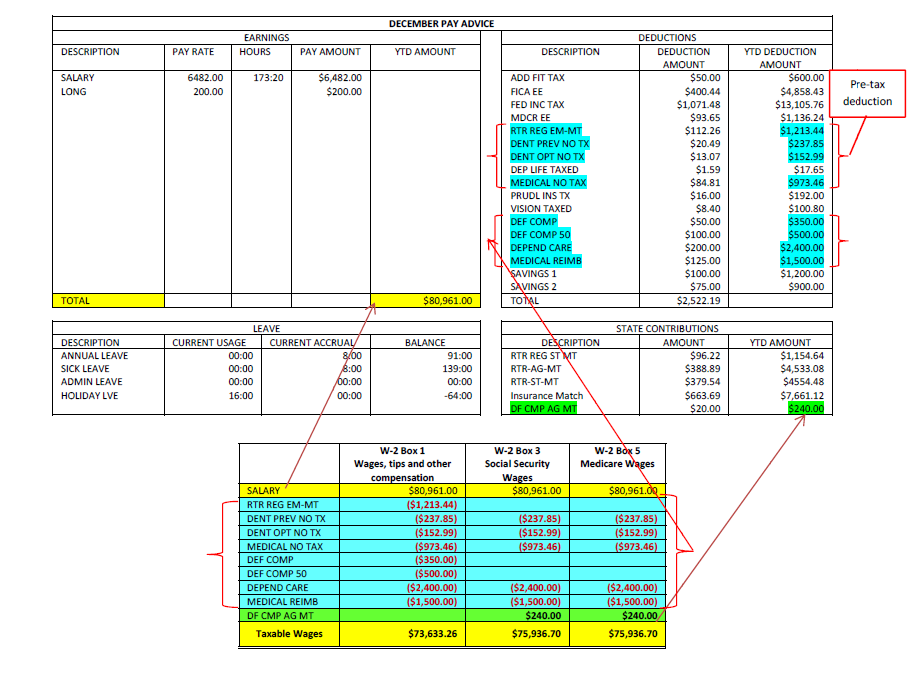

W2 to Paystub Reconciliation - Wyoming State Auditor's Office

de

por adulto (o preço varia de acordo com o tamanho do grupo)