What Eliminating FICA Tax Means for Your Retirement

Por um escritor misterioso

Descrição

A recent poll out said that over 60% of current retirees are relying on social security and Medicare for a majority of their income in retirement. So while getting rid of FICA tax sounds nice now because nobody likes paying taxes, it could be detrimental not just to retirees or when you can retire

401k: What Is It? How Does The Retirement Plan Work? (2023)

Social Security Is Essential. So Why Do Some Want to Cut It?

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)

Why Is There a Cap on the FICA Tax?

Social Security Income Penalties Are Refunded To You When You Reach Fully Retirement Age

Tax Tips for Retirement - TurboTax Tax Tips & Videos

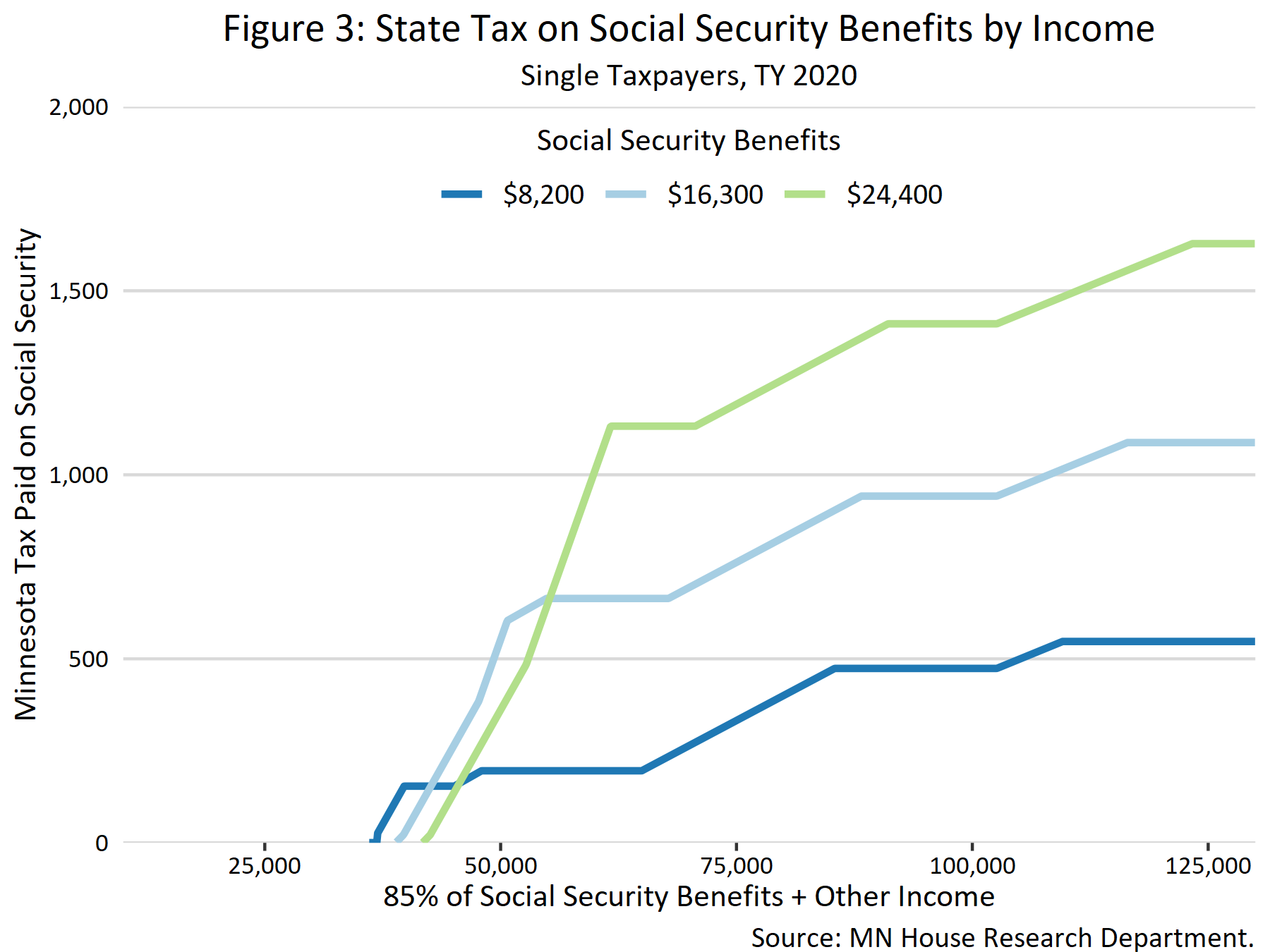

Taxation of Social Security Benefits - MN House Research

What Is FICA Tax: How It Works And Why You Pay

PERA and Social Security - PERA On The Issues

Program Explainer: Government Pension Offset

Is Social Security Going Bankrupt? Experts on the Future of Retirement Benefit - Bloomberg

FICA Tax: Unraveling the Mystery Behind Social Security Contributions - FasterCapital

The Future of Social Security

Here's a Way to Save Social Security and Defer RMDs

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)