FICA Tax: Understanding Social Security and Medicare Taxes

Por um escritor misterioso

Descrição

Both employees and employers are required to pay FICA tax, which is withheld from an employee

Social Security (United States) - Wikipedia

2023 FICA Tax Limits and Rates (How it Affects You)

What is Fica Tax?, What is Fica on My Paycheck

What Is FICA Tax?

Maximum Taxable Income Amount For Social Security Tax (FICA)

Social Security And Medicare Taxes Worksheet 1 - Math Worksheets - Fill and Sign Printable Template Online

What Is FICA on a Paycheck? FICA Tax Explained - Chime

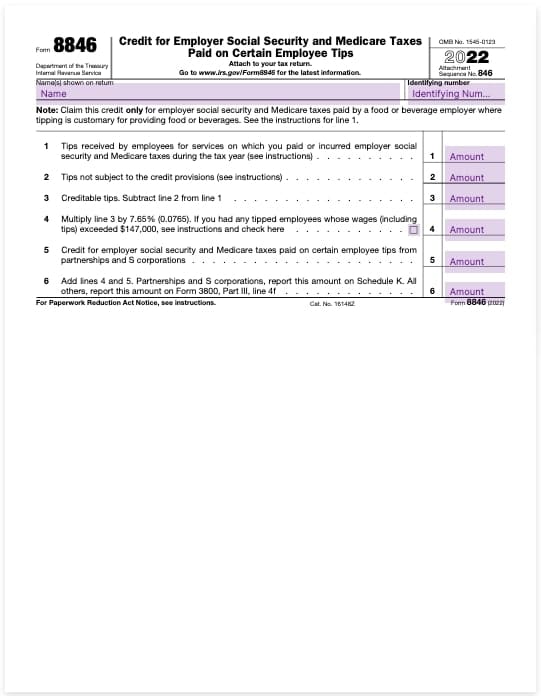

Form 8846: Credit for Social Security & Medicare Taxes Paid on Certain Employee Tips

What is the FICA Tax and How Does it Connect to Social Security?

The FICA Tax: How Social Security Is Funded – Social Security Intelligence

What are FICA Tax Payable? – SuperfastCPA CPA Review

How Much Does an Employer Pay in Payroll Taxes?

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

What Is FICA on a Paycheck? FICA Tax Explained - Chime

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)