Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Descrição

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

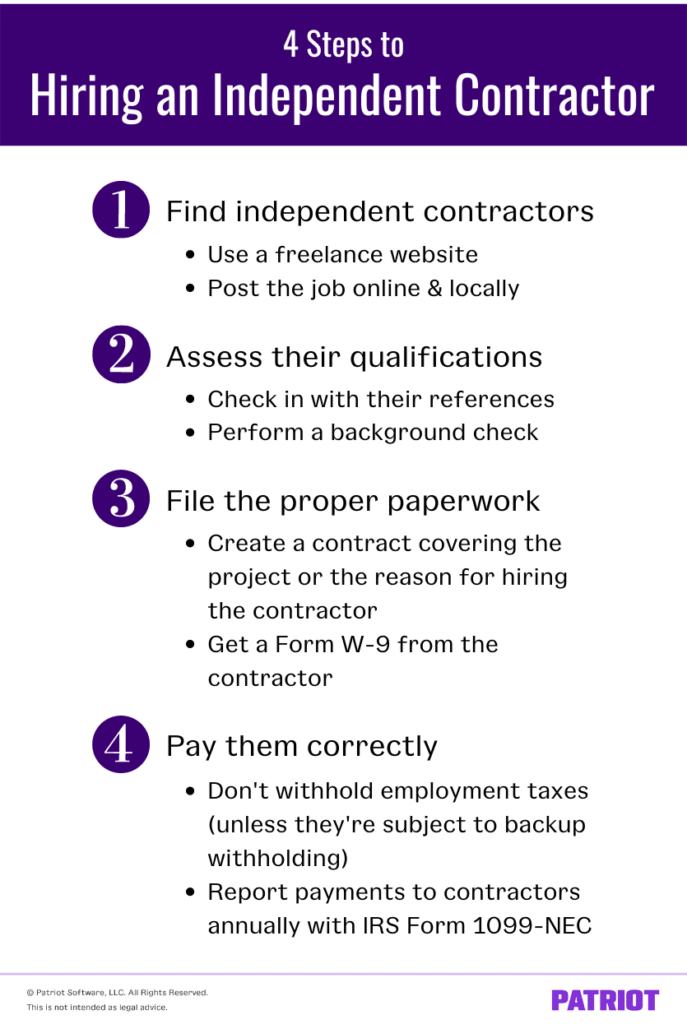

Everything to Know About Hiring an Independent Contractor

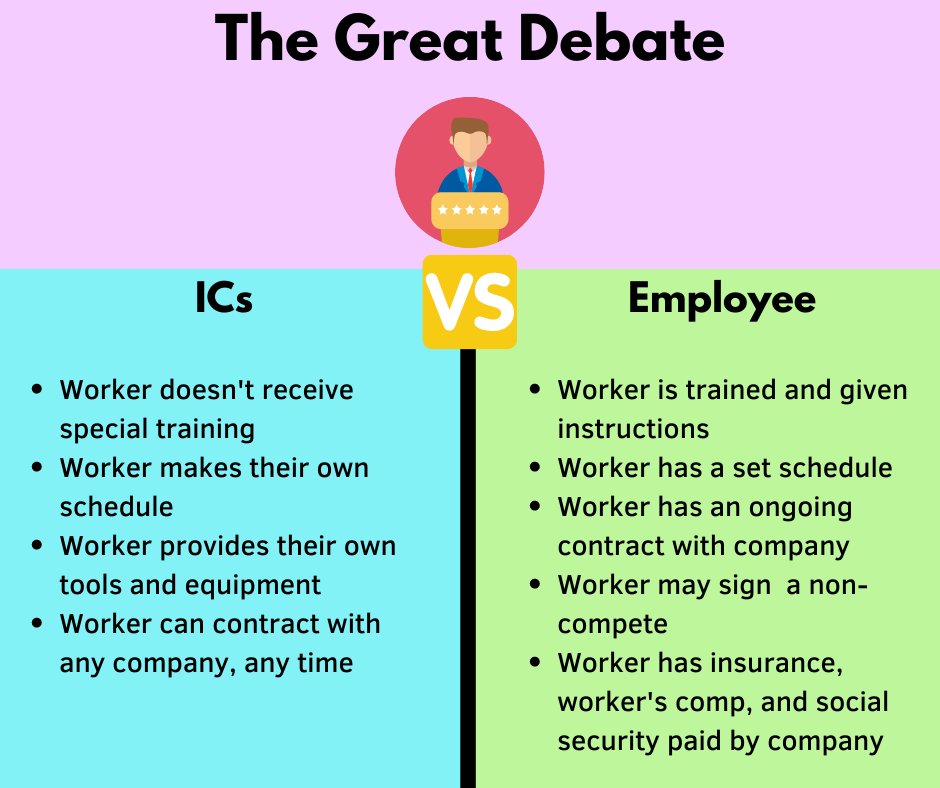

Independent Contractors vs. Employees: A Guide for Pet Sitters and

:max_bytes(150000):strip_icc()/california-assembly-bill-5-ab5-4773201-final-5dededce82a84362b2c83cbebb18abcd.png)

California Assembly Bill 5 (AB5): What's In It and What It Means

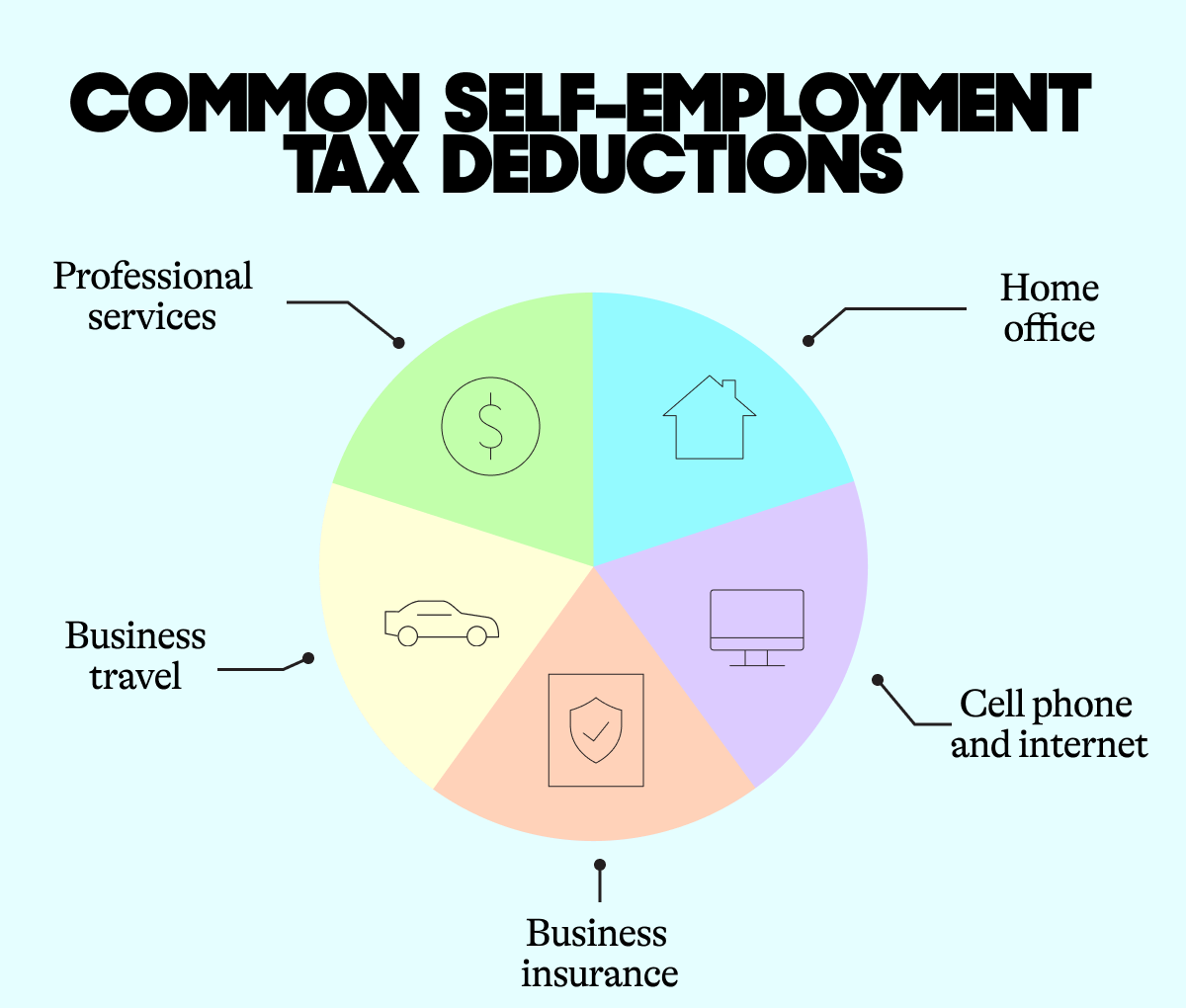

A Guide to Independent Contractor Taxes - Ramsey

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

Taxable Income: What It Is, What Counts, and How To Calculate

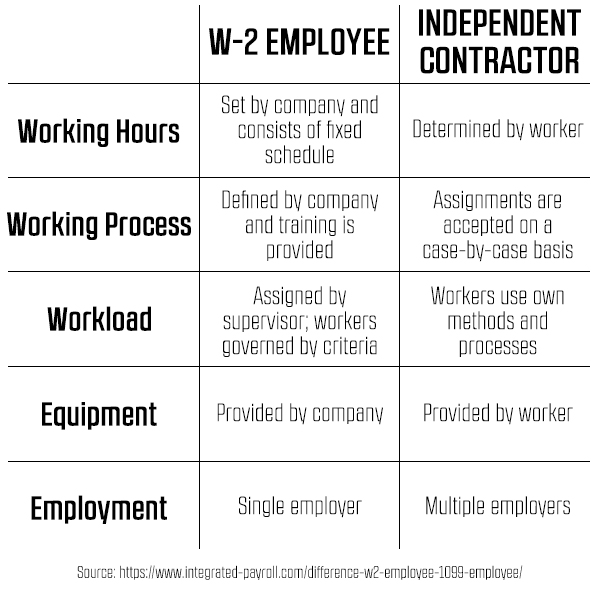

Do You Need a W-2 Employee or a 1099 Contractor? - How to Start

8 Benefits Of Being An Independent Contractor in 2023

16 Amazing Tax Deductions for Independent Contractors In 2023

10 Must-Haves in An Independent Contractor Agreement

What do the Expense entries on the Schedule C mean? – Support

Tax Topics: Employees and Independent Contractors in the Sharing

Doordash Is Considered Self-Employment. Here's How to Do Taxes

1099 vs W-2: What's the difference?

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How to Report and Pay Taxes on 1099-NEC Income

Insurance Review of Independent Contractors Risk and Insurance

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/retailbanking.asp-final-3474e513dbcb47919f81e440ffde237d.png)