Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Descrição

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Understanding Payroll Taxes and Who Pays Them - SmartAsset

Certified Payroll Services

Overview of FICA Tax- Medicare & Social Security

Breaking Down the Taxable Wage Base Limit: Implications for Your

What Is the FICA Tax?, Retirement

What is a payroll tax? Payroll tax definition, types, and

Federal & Regular FICA Tax Table Maintenance (FEDM & FEDS)

FICA explained: Social Security and Medicare tax rates to know in 2023

Capital Gains Tax Explained: What It Is and How Much You Pay

Understanding the Exact Cost of an Employee - true cost of

Employees Paychecks - FasterCapital

Understanding FICA Taxes and Wage Base Limit

:max_bytes(150000):strip_icc()/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is the Self-Employed Contributions Act (SECA) Tax?

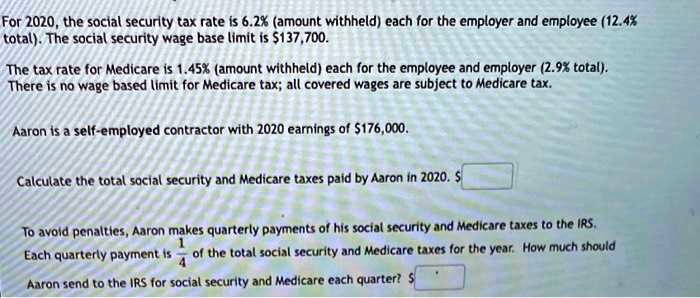

SOLVED: For 2020, the social security tax rate is 6.2% (amount

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/i.s3.glbimg.com/v1/AUTH_bc8228b6673f488aa253bbcb03c80ec5/internal_photos/bs/2021/m/d/emOnkrQgmgBMxzSRArEQ/thundurus-therian-counters-stats.png)