Students on an F1 Visa Don't Have to Pay FICA Taxes —

Por um escritor misterioso

Descrição

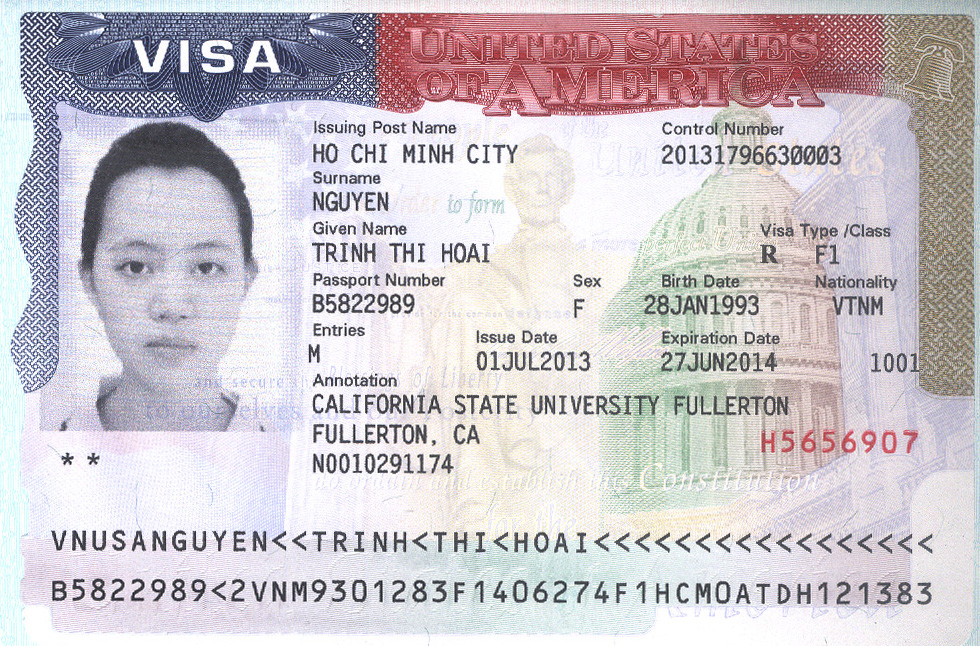

In general, non-US citizens employed in the U.S. are required to pay FICA taxes. However, those with single intent, or non-immigrant status (or F1 visa holders) are exempt from FICA taxes.

Filing Taxes While Overseas - TurboTax Tax Tips & Videos

U.S. Taxes Office of International Students & Scholars

What Students Need to Know About Filing Taxes This Year

OASDI Tax: What It Is, How It Works - NerdWallet

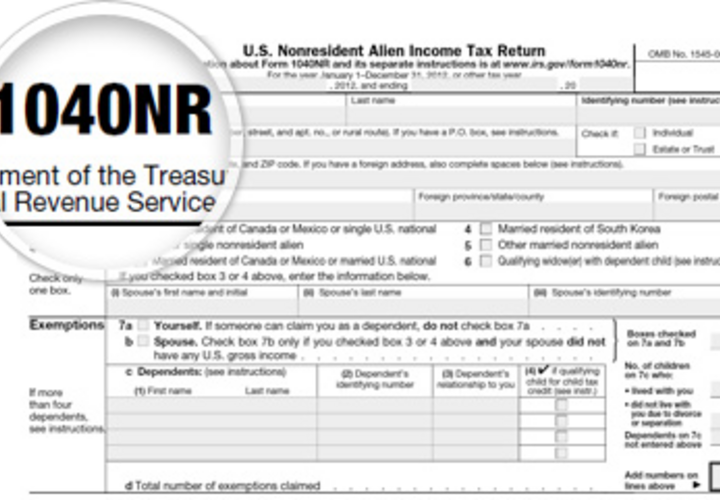

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

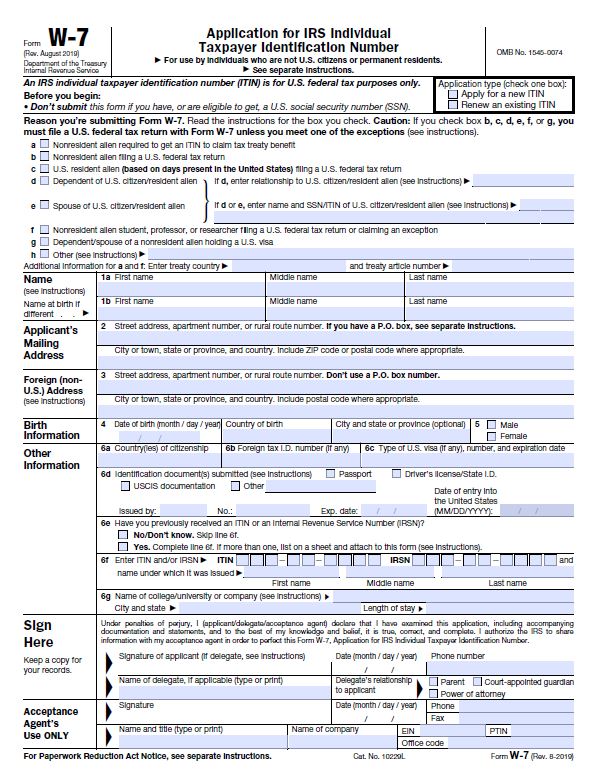

5 US Tax Documents Every International Student Should Know

FICA Tax Exemption for Nonresident Aliens Explained

How International Students Can Get A Credit Card

Social Security Number (SSN) for International Students on F1 Visa or J1 Visa

How Do I Get a FICA Tax Refund for F1 Students?

Do International Students Pay Taxes? A US Tax Filing Guide

Tax From Us - Get Started

Pros and Cons : Working in OPT or H1B Visa

All About F1 Student OPT Tax F1 Visa Tax Exemption & Tax Return

de

por adulto (o preço varia de acordo com o tamanho do grupo)