Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Descrição

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

What's worse than paying taxes? Paying tax penalties - Go Curry Cracker!

Safe harbors and other ways to avoid estimated tax penalties - Don't Mess With Taxes

Common IRS Penalties & How to Avoid Them - Optima Tax Relief

Avoiding Underpayment of Tax Penalty - TaxSlayer®

Penalty for Underpayment of Estimated Tax

IRS Penalty and Interest Calculator, 20/20 Tax Resolution

How Much is the IRS Tax Underpayment Penalty? - Landmark Tax Group

The Complexities of Calculating the Accuracy-Related Penalty

Avoiding Underpayment Penalty: The Consequences of Late Payment - FasterCapital

The Complexities of Calculating the Accuracy-Related Penalty

Tax returns 2019: IRS again lowers underpayment penalty after outcry - CBS News

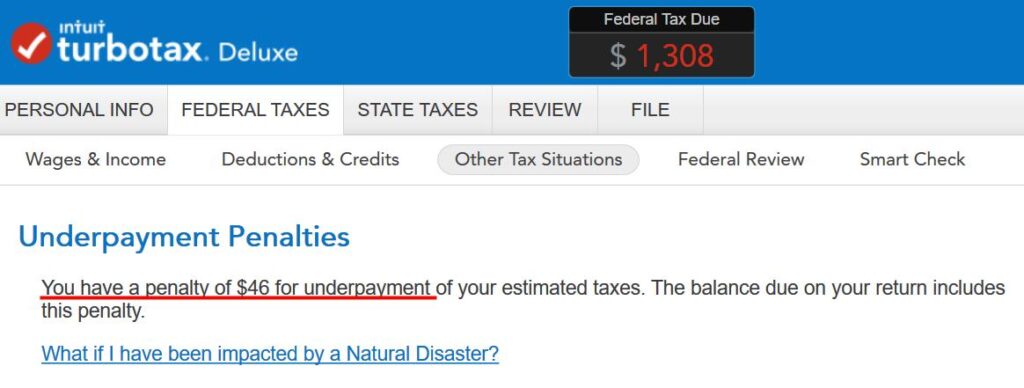

Opt Out of Underpayment Penalty in TurboTax and H&R Block

Tax Underpayment Penalty: How Much More Will You Pay the IRS for Not Paying the Full Amount You Owe - Wiztax

de

por adulto (o preço varia de acordo com o tamanho do grupo)