How derivative traders can make the most of increased volatility

Por um escritor misterioso

Descrição

It has become routine for Nifty to go up or down by 300 points —around 1,000 points on the Sensex—daily. Though heightened volatility unnerves normal investors, it spells opportunities for derivative traders.

Options Trading X, Vega distribution in relation to Volatility

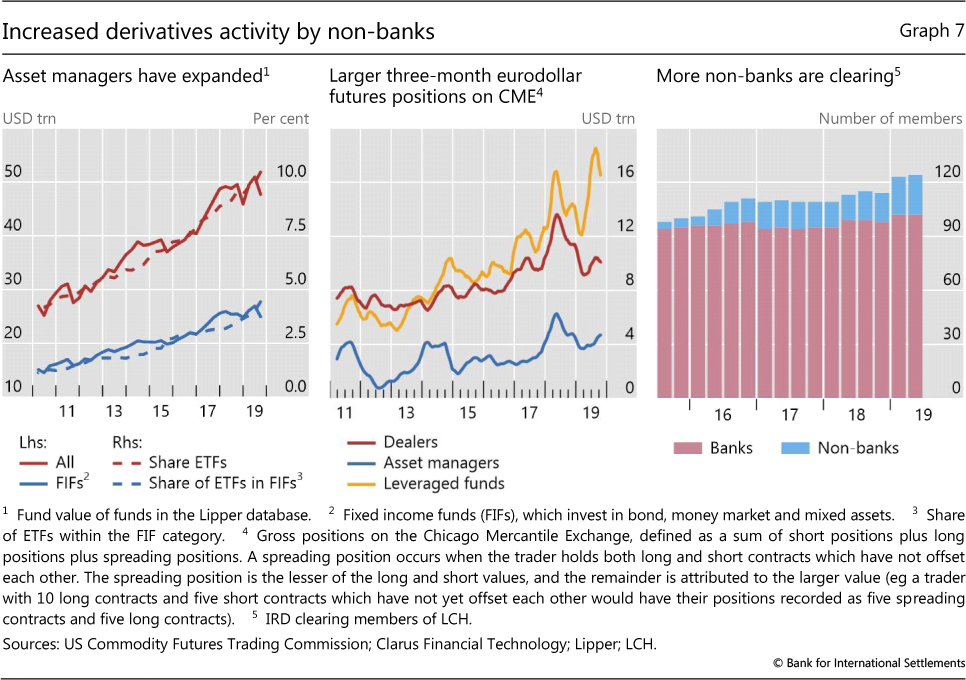

The evolution of OTC interest rate derivatives markets

Vega Explained: Understanding Options Trading Greeks

Volatility Insights: Evaluating the Market Impact of SPX 0DTE Options

Gross exposure in trading: Strategies for Managing Volatility

Know what are derivatives in trading and how to do derivatives

:max_bytes(150000):strip_icc()/derivative_final-fbb671f41d73438a96a5b8a8110145f0.png)

Derivatives: Types, Considerations, and Pros and Cons

Implied vs. Historical Volatility: Options Vega & Theta Explained

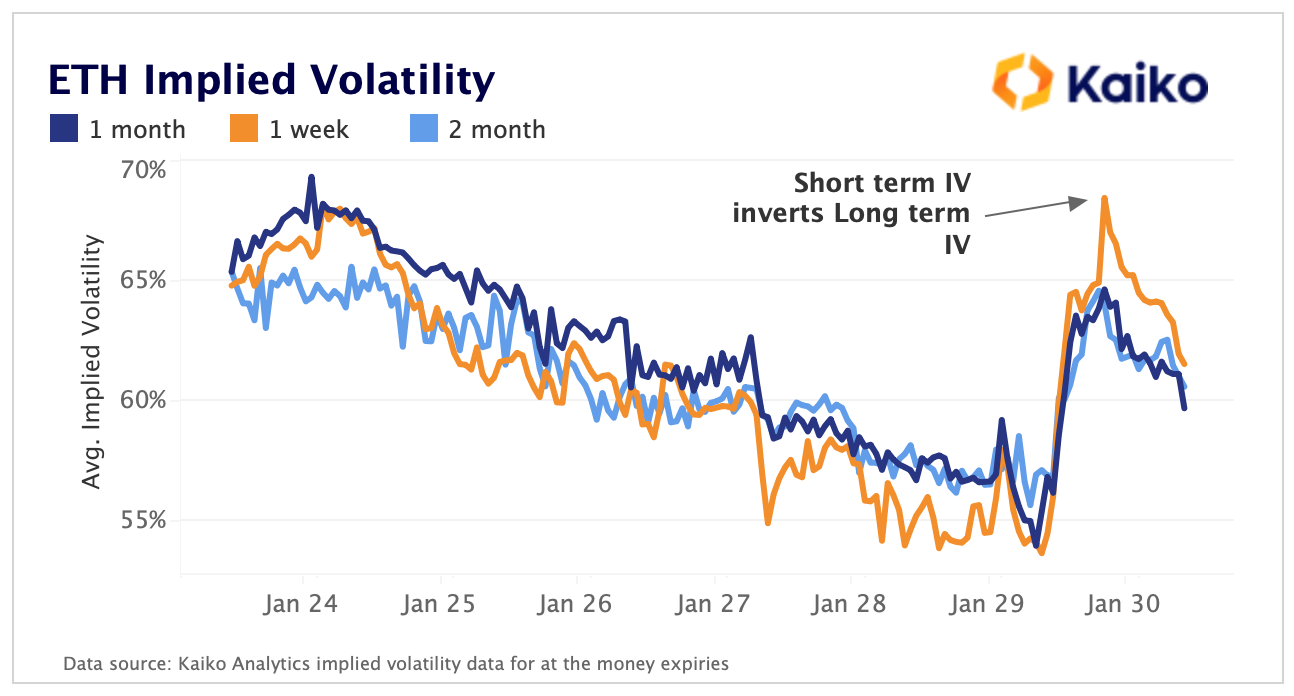

APT's Extraordinary Rally Examined, by Kaiko

de

por adulto (o preço varia de acordo com o tamanho do grupo)