MNCs sent tax notices over expat employees' allowances from foreign parent companies

Por um escritor misterioso

Descrição

The demands, ranging from ₹1 crore to ₹150 crore, cover the period between FY18 and FY22 for payments by foreign parent companies to expats working in Indian subsidiaries of MNCs

:max_bytes(150000):strip_icc()/cost-of-living.asp-final-174921c4b73c4741aeca1503f35cc2f4.png)

Cost of Living: Definition, How to Calculate, Index, and Example

Legal Entity Setup Overseas: Is It Really What You're Looking For?

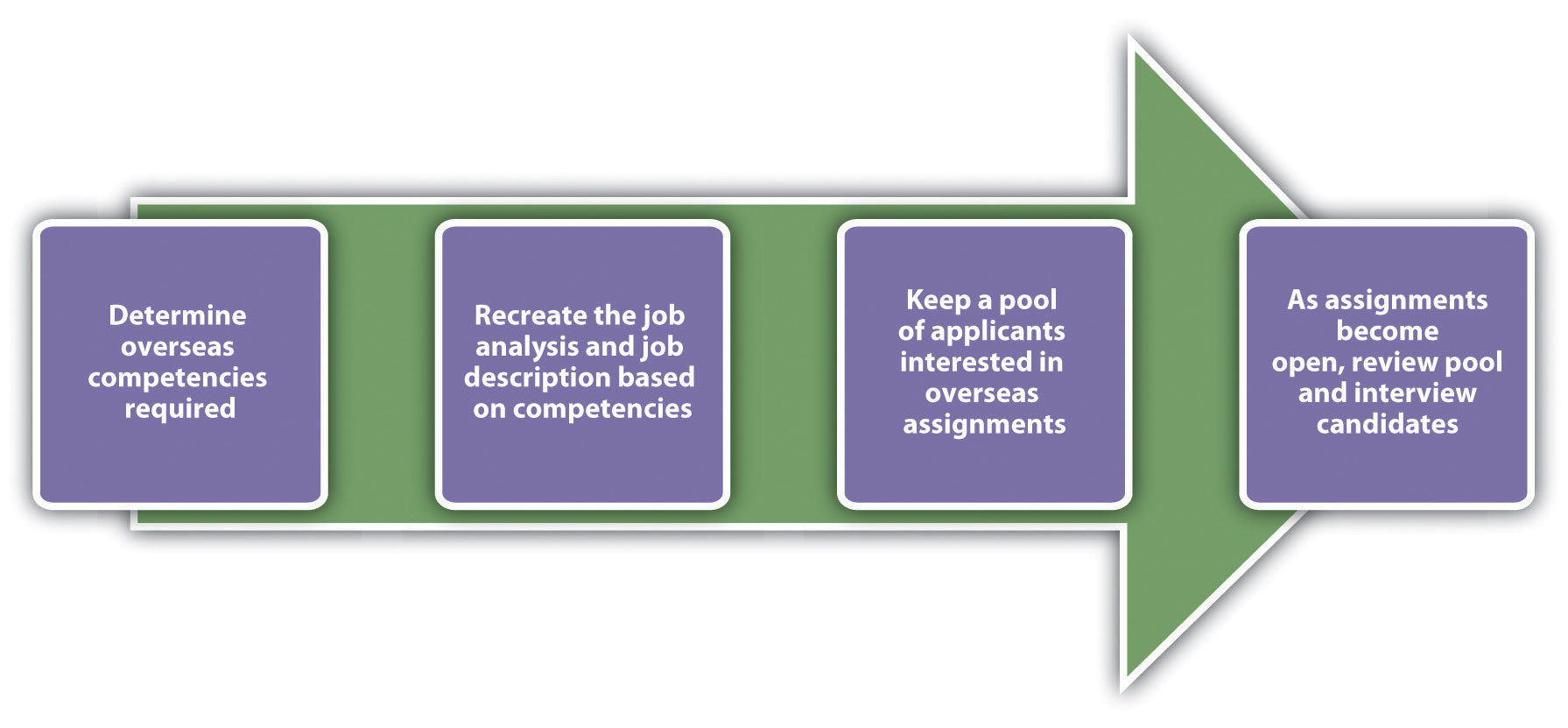

14.3 International HRM Considerations – Human Resource Management

Subsidiary employees' allegiance to three entities. Note. MNC =

Subsidiary Employees' Triple Allegiance: Differences Between Parent-

Fostering operational management “Best Practices” in subsidiary plants in the Western Balkans: The role of MNC home-country environment and resource allocation - ScienceDirect

View PDF - Fried Frank

Employers' Guide To International Employment Contract

Passthrough-entity treatment of foreign subsidiary income

de

por adulto (o preço varia de acordo com o tamanho do grupo)